Media Release

The Harvard Project Announces 2025 Honoring Nations Award Winners

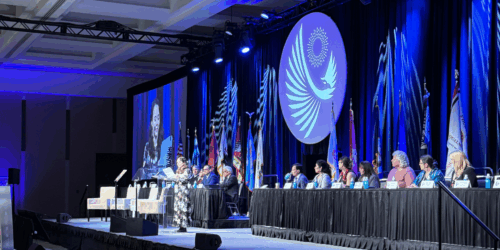

The national awards program Honoring Nations, flagship program of the Harvard Project, announces the recipients of the 2025 Honoring Nations Awards, recognizing 6 governmental initiatives for outstanding excellence in tribal self-governance.